Many of us see the sort of bonuses that these credit card companies offer, a higher 60 complaints after you spent fornicators in the first 3 months, some a lot of you guys spend $4000 in 3 months.

In this article, I will show you how to allocate the spend (Manufactured Spend) on the credit card, the $4000 that they want you to spend on gift cards, you can send back to the credit card company and have your balance zero and reap all the benefits.

If you really want to repair your credit on your own, check out the new eBook I wrote for you, Credit Repair 101. Simple instructions and illustrations will help you learn how to boost your Credit Score, and other amazing credit tips & tricks. Check out the samples on the product page.

What is manufactured spending (MS)?

In simple terms, manufactured spending is the process of turning credit card spending into cash, which you can then use to pay off the credit card.

The goal is two-fold:

- Meet the minimum spending requirements to get the signup bonus when you open a credit card without actually buying a lot of stuff (thus allowing you to open many cards at the same time and not struggle to complete the minimum spend on all of them),

- Generate a lot of frequent flyer miles without actually spending a lot of money.

Most people will stop at the first step because the same amount of effort would yield much higher rewards than the second step, but nothing stops you from ramping things up once you're comfortable with the process.

Let's say you want United miles so you open the Chase United credit card that gives 1x mile on every purchase, and the signup bonus is 50k miles after $3k spent. If you MS $3k, you would receive 53k miles (3k miles from your MS and 50k miles for the signup bonus). Now if you MS another $3k, you would only receive 3k more miles. Same effort but 17 times fewer miles.

How to Manufactured Spending

There are 5 steps to manufacture spend:

Open up a Credit Card

When you open up a credit card, for example with Chase Sapphire Preferred, if you want to know more about the best credit cards, check out my latest article about Best Credit Cards to Get If You’re Starting to Rebuild Credit.

In the first three months you have a signing bonus, Earn 100,000 bonus points after you spend $4,000 USD on purchases in the first 3 months, which is equivalent to 500 points or so, but most of them are more. Not spending $4000 USD is Your challenge.

Open up Visa gift cards

After you open up a credit card, what you need to do is go to CVS, Myers, the Mall, Wal-Mart,... any store and open up Visa gift cards (you can find them on the wall, they're usually on the front of the store). So you open up with a small fee, maybe $3 to $4 USD to put $500 USD each on 8 Visa gift cards equals to $4000 USD in total.

So you open up a Credit Card, you use that same Credit Card to open up 8 different Visa gift cards, preferably from Wal-Mart or Myers, if that's close to you and you have $4000 USD Visa gift cards.

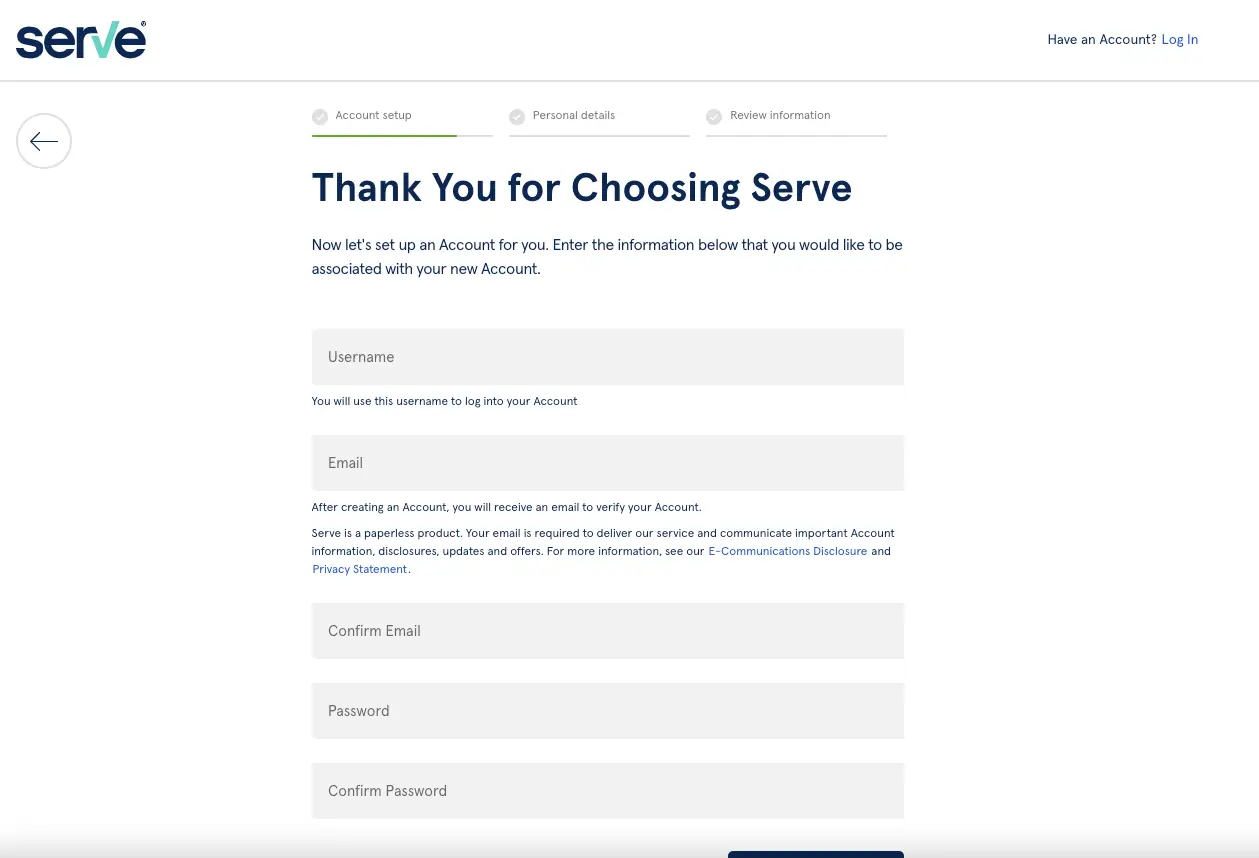

Open up AMEX PREPAID account

After you open the visa gift cards and you go to Bluebird.com or Serve.com (you can do this before you don't have to do it right after. If you want to save time), which are basically Amex prepaid cards. They're not credit cards and gift cards. All you got to do is open up an account, fill out all the information.

Go Back to Walmart, Myers,...

And then when you get a Card after 5-7 business days, you go to the cashier and you want to upload money on your Bluebird's or Serve's account. And then how you can upload with the money is you're going to use those Visa Gift Cards. Don't tell the cashier that they're gift cards, they're considered debit cards.

So you upload all the money from your Visa Gift Cards onto those Serve or Bluebird accounts.

Go Back To Serve.com or Bluebird.com

Now the money went from your Visa Gift Card to the Serve or Bluebird account. Once you get to Serve.com or Bluebird.com, all your money should be there. You go to Pay Bill, put in your credit card name, which is, in this case, Chase Sapphire Preferred, or whatever credit card you have, Capital One, Freedom, Discover, Amex Platinum,.... and then you pay directly from your Serve or Bluebird account back to your credit card balance. And so now you have a Zero balance from the $4000 USD you spend plus the $500 USD bonus that they gave you.

You do this with every credit card that offers a signing bonus and then you don't have to worry about spending $4000 USD and get -$4000 USD in the bank, plus one bonus and that's going to save you money to pay money out of pocket. It's using the money from the credit card issuer back to the credit card issuer in indirect ways.

Advantages of Manufactured Spending:

- Rewards and Points: The primary benefit of manufactured spending is that it allows individuals to earn rewards and points without actually spending money. This can be especially valuable for those who are chasing sign-up bonuses or trying to maximize reward points on their credit cards.

- Boost Credit Scores: Using credit cards for manufactured spending can help improve credit scores, as long as payments are made on time and the balance is kept low. This is because a high credit utilization rate (the ratio of credit used to credit available) can negatively impact credit scores. By artificially increasing spending and keeping balances low, individuals can help maintain or improve their credit scores.

- Flexible Payment Options: Manufactured spending allows individuals to pay for bills and expenses with more flexibility. For example, they can purchase prepaid cards or gift cards with a credit card, then use these to pay for expenses that might not normally accept credit cards, such as rent, mortgage payments, or student loans.

Disadvantages of Manufactured Spending:

- Fees and Costs: Manufactured spending often comes with fees and costs that can add up quickly. For example, some prepaid cards or gift cards charge activation fees, maintenance fees, or transaction fees. These can eat into the rewards or points earned through MS and negate the benefits of the strategy.

- Fraud Risks: Manufactured spending can also come with risks of fraud or theft. For example, some gift cards or prepaid cards may not be secure, and the funds on them can be stolen or lost. Additionally, some merchants may not accept gift cards or prepaid cards, which can lead to complications and missed payments.

- Credit Score Risks: Manufactured spending can also have a negative impact on credit scores if not managed properly. If balances are not paid on time or are allowed to accumulate, credit scores can suffer. Additionally, if credit card issuers suspect that individuals are engaging in MS to artificially inflate their spending, they may investigate and take action, such as closing accounts or reducing credit limits.

Bottom line

In conclusion, manufactured spending can be a valuable strategy for earning rewards or points, but it's important to carefully consider the risks and costs involved before getting started. Individuals should research and compare different methods and fees, and use manufactured spending in moderation to avoid drawing attention from credit card issuers.

If you really want to step up your game, check out the new eBook I wrote for you, Credit Repair 101. Simple instructions and illustrations will help you learn how to boost your Credit Score, and other amazing credit tips & tricks. Check out the samples on the product page.

FAQs:

- Is manufactured spending illegal?

No, manufactured spending is not illegal. However, credit card issuers may have policies against the practice and may take action against individuals who engage in it.

- How can I avoid fees and costs associated with manufactured spending?

To avoid fees and costs, individuals should research and compare different gift cards, prepaid debit cards, or other methods you use for manufactured spending.