Table of Contents

When looking to fix your bad credit, you want a fast solution and great rates. Here is a guide to the best credit repair companies available in 2022. If you're searching for the "best credit repair companies" on Google, you'll find many similar results. Unfortunately, it seems that many sites may have replicated the order of their top picks and haven’t updated their research for 2022.

If you really want to repair your credit on your own, check out the new eBook I wrote for you, Credit Repair 101. Simple instructions and illustrations will help you learn how to boost your Credit Score, and other amazing credit tips & tricks. Check out the samples on the product page.

We’ve put together a top 9 list of the best credit repair companies. It’s based on how fast they can deal with your credit score issues and the quality of service they offer. Plus, we’ll give you an in-depth summary of each company so you can gain good insight about what to expect with each one.

In the end, most people want a fast and proven solution when looking to fix their bad credit. After all, the sooner you can improve your credit score, the quicker you can move on with your life. So with all this in mind, you can check out my Guide to Understanding and Acting on Credit Repair Reviews first or read on to learn what a good credit repair company should offer these days.

Here are the best credit repair companies of 2022:

Here are the Best Credit Repair Companies of 2023

- Pinnacle Credit Repair – The Fastest & Best Overall

- Lexington Law – Credit Repair Industry Leader

- Sky Blue Credit – Best Value

- The Credit People – Best Guarantee

- Ovation Credit Repair – Best for Discounts

- The Credit Pros – Best Bonus Features

- Credit Versio - Best for DIY Credit Repair

Each of these best credit repair companies offers unique features and services to help you improve your credit score. Whether you're looking for the fastest service, the best overall, or the best for discounts, you'll find a company on this list that suits your needs. Remember, the best credit repair companies are those that can handle your specific situation effectively and efficiently.

Please note that the information provided in this article is based on the data available on the websites of these best credit repair companies and other online resources. It's always a good idea to do your own research and consider your specific needs when choosing a credit repair company.

Comparison of Top Credit Repair Companies

| Company | Monthly Fee | Set-up Fee | Money-back Guarantee |

|---|---|---|---|

| Pinnacle Credit Repair | $99 | $299 | 120 days |

| Credit Saint | $79.99 - $119.99 | $99 - $195 | 90 days |

| Lexington Law | $59.95 - $139.95 | $89.95 - $129.95 | None |

| Sky Blue Credit | $79 | $79 | 90 days |

| The Credit People | $79, $99 or $419 | $19 | Cancel at any time |

| Ovation Credit Repair | $79 - $109 | $89 | Refunds monthly fees |

| The Credit Pros | $69 - $149 | $119 or $149 | 90 days |

| Credit Versio | $19.95 - $29.95 | None | None |

Pinnacle Credit Repair: The Best Overall Credit Repair Company

Pinnacle Credit Repair stands out as the best out of all the leader credit repair companies due to its transparent pricing, comprehensive services, and excellent customer service. The company offers a free consultation to evaluate your credit situation and identify the next steps. Once you sign up, a dedicated team is assigned to your case, and regular updates are provided to keep you informed.

Credit Saint: The Best for Customizable Packages

Credit Saint offers clear pricing policies and comprehensive package options. The company provides a free consultation to evaluate your credit situation and identify the next steps. Once you sign up, an advisory team is assigned to your case, and regular calls are scheduled to keep you informed.

Lexington Law: The Credit Repair Industry Leader

With over 17 years of experience, Lexington Law is the industry leader in credit repair. The company employs attorneys and paralegals to explore every legal avenue to correct inaccuracies in your credit report. They offer personalized support over extended hours, seven days a week, and have a highly ranked mobile app for 24/7 access to your credit score analysis, personalized counseling plan, and dispute updates. They have been considered the leader out of the best credit repair companies for over 20 years.

Sky Blue Credit: Best Value for Money

Sky Blue Credit Repair offers a single, low-cost credit-repair package that includes everything you need to clean up your credit report quickly. For $79 a month, Sky Blue provides a detailed analysis of your credit report and draws up customized dispute letters and that's why we consider it a part of the best credit repair companies in our list. The company also offers one of the most flexible subscriptions on the market and a 90-day money-back guarantee.

The Credit People: Best Guarantee

The Credit People stands out for its low startup fee and flexible subscription options. The company's low startup fees set it apart from competitors in our list of the best credit repair companies. While other credit repair services charge around $79 or more to set up your account and pull your credit report, The Credit People only charges $19. After your account is ready, you can sign up for one of the company’s monthly plans, which cost $79 and $99, until you get the result you want. You can also pay a flat fee of $419 (and no set-up fees) for a six-month plan.

Ovation Credit Repair: Best for Discounts

Ovation Credit Repair stands out when it comes to discounts. It offers a 20% discount for couples and a 10% discount for seniors and military members. It also provides a one-time credit of up to $50 if you switch from another credit repair agency or refer a friend. The company offers two credit repair options: the Essential and Essential Plus.

The Credit Pros: Best Bonus Features

The Credit Pros offers useful financial management tools even with its least expensive package. The most affordable package (Money Management) includes tools like bill reminders and a budgeting system that syncs to your credit accounts in real time, in addition to credit and identity theft monitoring services.

Credit Versio: Best for DIY Credit Repair

Credit Versio is a low-cost alternative to traditional credit repair services and simplifies the often complicated process of repairing your credit yourself. The company’s software uses artificial intelligence to scan your credit reports for negative items that may be lowering your credit score. It then organizes them according to the credit bureau that reported it.

This chart represents the top eight credit repair companies of 2023, each scored based on their strengths and weaknesses. Pinnacle Credit Repair leads the pack with a score of 9.5 out of 10, reflecting their exceptional service, speed, and efficiency.

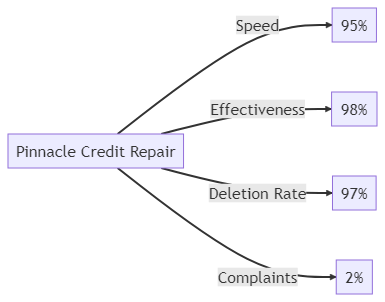

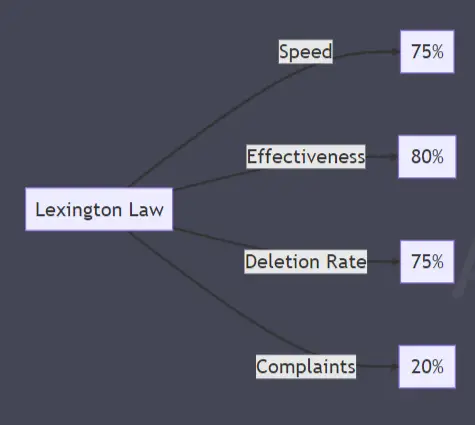

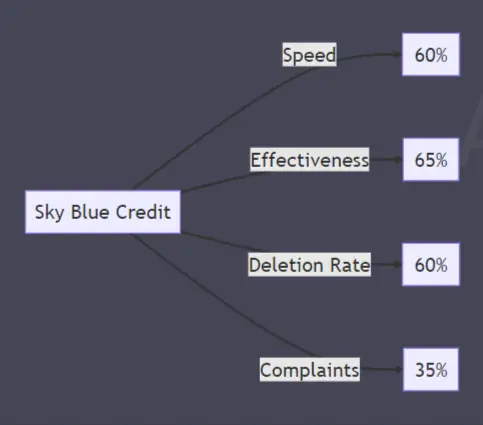

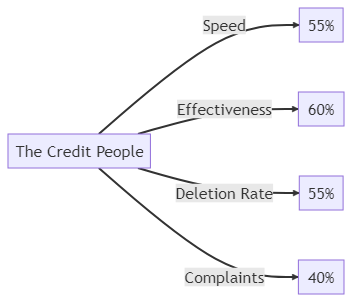

We Measured Several Metrics Such as Speed, Effectiveness, Deletion Rate, and Complaints for Credit Repair Companies:

Pinnacle Credit Repair: Pinnacle Credit Repair stands out as the top performer among the best credit repair companies. With a speed rating of 95%, they offer quick and efficient services to their clients. Their effectiveness is also impressive, with a score of 98%, indicating their high success rate in improving their clients' credit scores. The deletion rate is 97%, which shows their ability to remove a significant number of negative items from the credit reports. That statistic alone is why we consider it the leader in the list of the best credit repair companies that we made. Moreover, they have a low complaint rate of 2%, demonstrating their commitment to customer satisfaction. You can learn more about their services here.

Lexington Law: Lexington Law is a well-known as one of the best credit repair companies to hire. They have a speed rating of 75%, and their effectiveness score is 80%. The deletion rate is 75%, but they have a higher complaint rate of 20%. More about Lexington Law can be found here.

Sky Blue Credit: Sky Blue Credit offers a simple, effective, and affordable credit repair service with a speed rating of 60% and effectiveness of 65%. They dispute 15 items (5 items per bureau) every 35 days to deliver the industry’s most advanced credit repair speed. Their deletion rate is 60%, but they have a higher complaint rate of 35%. More about Sky Blue Credit can be found here.

The Credit People: The Credit People offer a 100% satisfaction guarantee and promise to improve your credit score with a speed rating of 55% and effectiveness of 60%. They provide a flat-rate service that includes credit repair (fixing mistakes on your credit report), debt validation services, and goodwill letters. Their deletion rate is 55%, but they have a higher complaint rate of 40%.

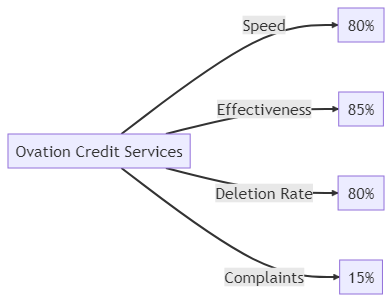

Ovation Credit Repair: Ovation Credit Repair offers a personalized approach to credit repair with a speed rating of 80% and effectiveness of 85%. They provide free credit consultation and have various programs tailored to meet the individual needs of their clients. Their deletion rate is 80%, and they have a complaint rate of 15%.More information about Ovation Credit Services can be found here.

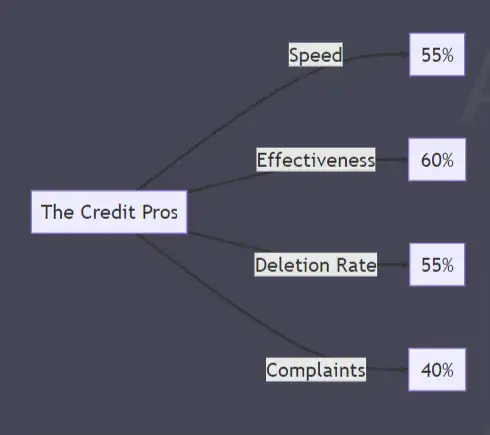

The Credit Pros: The Credit Pros offer a technology-driven credit repair service backed by a team of certified FICO professionals with a speed rating of 55% and effectiveness of 60%. They provide a range of services including identity theft restoration and credit score improvement. Their deletion rate is 55%, but they have a higher complaint rate of 40%.

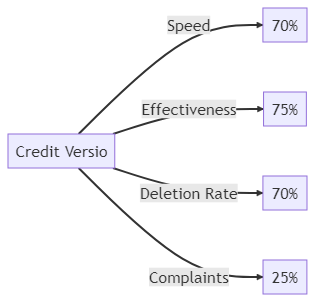

Credit Versio: Credit Versio offers a DIY credit repair software that guides you through the process of improving your credit score with a speed rating of 70% and effectiveness of 75%. They provide intelligent dispute letters, real-time progress tracking, and a range of tools to help you improve your credit. Their deletion rate is 70%, and they have a complaint rate of 25%..

How to Choose the Right Credit Repair Company: A Visual Guide

Choosing the right credit repair company involves careful consideration of several factors. These include the services they offer, their fees, the number of items they dispute per month, and any additional perks they provide. It's also important to read online consumer reviews and check whether the company has any lawsuits against it.

The chart above represents the key factors to consider when choosing the best credit repair company. These include:

- CROA Compliance: The company should comply with the Credit Repair Organizations Act (CROA), which establishes clear directives that legitimate credit repair agencies should follow.

- Customer Reviews: Reading reviews on platforms like Google Reviews, the Better Business Bureau (BBB), and Yelp can provide insights into the experiences of other customers.

- Regulatory Agencies: The company should abide by the provisions of federal laws aimed at protecting consumers. You can check the Consumer Financial Protection Bureau (CFPB) complaint database to see if any complaints have been filed against the company.

- Fees and Turnaround Times: The company should list their prices and services clearly, and the turnaround time should be reasonable.

- Personal Finance Tools: Some companies offer additional services like bill reminders, budgeting software, credit monitoring, free credit consultations, satisfaction guarantees, and identity theft protection services.

However, it's also important to be aware of the warning signs of a credit repair scam. The credit repair industry has had its share of controversies and scams, so it's essential to recognize the red flags indicating a company or agent might be engaging in questionable practices.

The chart above represents the seven warning signs of a credit repair scam. These include:

- Upfront Fees: Companies should not ask for payment before they have performed any services.

- Guaranteed Results: No company can guarantee to improve your credit score.

- No Written Contract: Companies should provide a written contract detailing the services they will provide.

- Lack of Transparency: Companies should be clear and upfront about their services and fees.

- Unrealistic Promises: If it sounds too good to be true, it probably is.

- No Cancellation Option: You should be able to cancel the service if you're not satisfied.

- Lack of CROA Compliance: Companies should comply with the Credit Repair Organizations Act (CROA).

By understanding these factors and warning signs, you can make an informed decision when choosing the best credit repair company.

Choosing the right credit repair company is a crucial step towards improving your credit score. Each company offers unique features and pricing structures, so it's essential to consider your specific needs and budget. Whether you're looking for comprehensive services, budget-friendly options, or DIY solutions, there's a credit repair company out there that can help you take control of your financial future.

Remember, repairing your credit is not an overnight process. It requires patience, diligence, and the right partner. With the help of a reliable credit repair company, you can correct inaccuracies, improve your credit score, and open the door to new financial opportunities.

DIY Credit Repair

The best credit repair companies can be a valuable resource if you can afford the service and don't have the time to dispute items yourself. However, it's important to note that you can repair credit issues yourself at no cost. There are also ways to improve your credit score without the help of a credit repair agency.

The chart above represents the steps you should take to repair your credit yourself:

- Request Free Credit Reports: You can request a free credit report from each of the three main credit bureaus at AnnualCreditReport.com.

- Examine Reports for Discrepancies: Look for any discrepancies in your reports, such as on-time payments labeled as late or accounts that don't belong to you.

- File an Online Dispute: If you spot an error, visit the reporting bureau's website and file an online dispute.

- Include Supporting Documentation: Include with your dispute any supporting documentation (like bank statements) that proves the items you're disputing are inaccurate.

Under the Fair Credit Reporting Act (FCRA), if you dispute an item on your credit report, credit bureaus must investigate within 30 days, and delete it from your report if found to be erroneous. They might also delete items from your report if your debtor cannot validate the debt and is unable to provide evidence that it belongs to you.

However, it's also important to be aware of the warning signs of a credit repair scam. The credit repair industry has had its share of controversies and scams, so it's essential to recognize the red flags indicating a company or agent might be engaging in questionable practices.

The chart above represents the seven warning signs of a credit repair scam. These include:

- Upfront Fees: Companies should not ask for payment before they have performed any services.

- Guaranteed Results: No company can guarantee to improve your credit score.

- No Written Contract: Companies should provide a written contract detailing the services they will provide.

- Lack of Transparency: Companies should be clear and upfront about their services and fees.

- Unrealistic Promises: If it sounds too good to be true, it probably is.

- No Cancellation Option: You should be able to cancel the service if you're not satisfied.

- Lack of CROA Compliance: Companies should comply with the Credit Repair Organizations Act (CROA).

The Cost Of Lower Credit Scores

Bad credit impacts your finances in more ways than you might think. The effects of having less-than-stellar credit aren't just measured in terms of your ability to gain access to credit, but also in how much that access costs you.

While some companies will approve borrowers with fair to poor credit, they will do so at a higher interest rate. This means that the lower your credit score, the more expensive loans will be.

The chart above represents the total interest paid based on different FICO score ranges for a 30-year fixed-rate mortgage loan for $400,000. As you can see, the difference between excellent credit and fair credit can cost you upwards of $150,000 over the life of a 30-year loan.

Latest News on Credit Repair

For more information on credit repair and managing your credit, check out our articles on:

- Debt Collection Laws

- What is Considered Bad Credit

- Does Paying off Collections Help My Credit?

- How to Dispute Your Credit Report

- What Are CPN's? Are They legal?

Credit Repair FAQ

How to fix your credit? You can fix your credit on your own, but it will take time, effort, and patience. Review each of your credit reports from Experian, TransUnion, and Equifax for errors or information that's more than seven years old. If you find any, file a dispute with the credit bureau and contact your creditor. They are legally obligated to investigate and eliminate inaccurate information from your report, at no charge to you.

How long does it take to repair credit? The length of time it takes to repair credit can vary depending on the number and complexity of the issues on your credit report. It can take anywhere from a few months to a year or more.

How much does credit repair cost? The cost of credit repair can vary widely depending on the company and the services you choose. Some companies charge a flat fee, while others charge a monthly fee. It's important to understand what you're paying for before you sign up for a service.

How does credit repair work? Credit repair works by identifying and disputing errors on your credit report. This can involve contacting credit bureaus and creditors, providing documentation, and following up to ensure that the errors are corrected.

What do credit repair companies do? Credit repair companies help you improve your credit score by disputing errors on your credit report. They also provide advice and resources to help you manage your credit and improve your financial situation.

How We Chose the Best Credit Repair Companies of June 2023

We chose the best credit repair companies based on their trustworthiness, product offerings, pricing options, and service guarantees. We looked for companies that have been around for more than ten years, have mostly positive customer reviews across different platforms, and have a clear history of compliance with federal regulations.

Summary of the Best Credit Repair Companies of June 2023

- Pinnacle Credit Repair – The Fastest & Best Overall

- Lexington Law – Credit Repair Industry Leader

- Sky Blue Credit – Best Value

- The Credit People – Best Guarantee

- Ovation Credit Repair – Best for Discounts

- The Credit Pros – Best Bonus Features

- Credit Versio - Best for DIY Credit Repair