Introduction

Expedited Credit repair is a topic that's on everyone's mind, in fact if you're reading this its because you typed "expedited credit repair" into google or something related to it and it popped up on the first page. That should tell you that nearly everyone with bad credit is searching for a quick credit fix. In today's economy where credit scores can make or break you, getting your credit wiped clean fast seems to be the answer. Whether you're looking to buy a home, get a loan, or even land a job, your credit score matters but before you hire any credit repair company lets explore the key elements that differentiate fast credit repair services from slow ones.

Credit repair is the process of improving your credit score by identifying and resolving issues that negatively impact it. This could involve disputing incorrect information on your credit report, negotiating with lenders to remove negative items, or addressing issues stemming from identity theft. But how you go about disputing these issues can significantly affect the speed and effectiveness of your credit repair journey. Let's delve into the four primary methods of dispute: mail, fax, phone, and online.

Four Ways to Dispute

1. Mail

The traditional and most commonly used method in the mainstream credit repair industry is disputing by mail. This involves sending a formal dispute letter to the credit bureaus, asking them to investigate and remove the inaccurate information. While this method is widely accepted, it's often the slowest, taking weeks or even months to get a response.

2. Fax

Faxing your dispute is another option, and it's slightly faster than mail. However, not all credit bureaus accept faxes, and there's always the risk of your fax getting lost or not processed promptly.

3. Phone

Disputing by phone can be quick but comes with its own set of challenges. It's often difficult to keep a record of what was discussed, and you may find yourself transferred from one department to another, wasting valuable time.

4. Online

Online disputes are becoming increasingly popular due to their speed and convenience. You can log in to the credit bureau's website and directly dispute the inaccurate information. However, the online forms may limit the amount of information you can provide, potentially weakening your case.

The Mainstream Credit Repair Industry

It's important to note that the mainstream credit repair industry primarily uses the mail method for disputes. While this is a tried-and-true method, it's often the slowest. If you're looking for fast credit repair, you may want to consider other methods or companies that utilize a multi-faceted approach to disputing errors on your credit report.

Expedited Credit Repair vs. Slow Credit Repair

Remember, there's a difference between expedited credit repair and slow credit repair. The method of dispute you choose can significantly impact how quickly you see results. While mail disputes may eventually get you the results you want, they often take much longer than online or phone disputes. Therefore, if speed is a priority for you, it's crucial to consider these factors when choosing a credit repair strategy or company.

Three Key Elements for Expedited Credit Repair

1. Identifying Violations

Before diving into the dispute process, it's crucial to identify any violations on your credit report. The more violations you can identify, the stronger your case will be. However, not all violations are created equal. Some may be more impactful than others, and some may only reveal themselves over time. Therefore, it's essential to conduct a thorough review of your credit report and other financial documents to build a strong case.

2. Methods of Dispute

The method you choose for disputing errors on your credit report can significantly impact the speed of the repair process. While many people opt for mail disputes, this method has proven to be less effective. On the other hand, online disputes can be quicker but must be done correctly to be effective.

3. Frequency of Disputes

Sending a single dispute is unlikely to resolve all the issues on your credit report. It's essential to send multiple disputes, targeting different issues, to increase the chances of improving your credit score. The frequency of these disputes can make a significant difference in how quickly your credit is repaired.

We Found The Fastest Credit Repair Company

Today, we're diving into the three most crucial elements in the credit repair industry. Before you heed the advice of any so-called experts on YouTube, it's essential to consider their credibility. Many of my clients are highly qualified individuals, some of whom are CEOs or business owners, and they've found that popular online advice often doesn't yield results. So, how do we determine what actually works? The answer lies in data and case studies.

I've previously released a video discussing the effectiveness of online vs. mail disputes, which is highly relevant to today's topic. In that video, I presented four independent case studies, including federal government data, to show what's effective and what's not. I highly recommend checking it out for more information.

Now, let's get into the elements:

- Identifying Violations: Before you dispute anything, you need to identify violations on your credit report. The more violations you find, the stronger your case. However, it's not just about quantity; the quality of these violations is equally important. If you don't have a strong case, you'll be ignored, just like the majority of disputes that credit bureaus receive.

- Methods of Dispute: It's crucial to diversify your methods of dispute. Relying solely on mail disputes, for example, is ineffective. According to data, less than 2% of mailed disputes get addressed. Therefore, it's essential to use various methods, including online disputes, to increase your chances of success.

- Frequency of Disputes: Sending just one dispute won't cut it. You need to be persistent and consistent in your efforts. The data shows that a single round of disputes is unlikely to be effective, so it's crucial to send multiple disputes to get results.

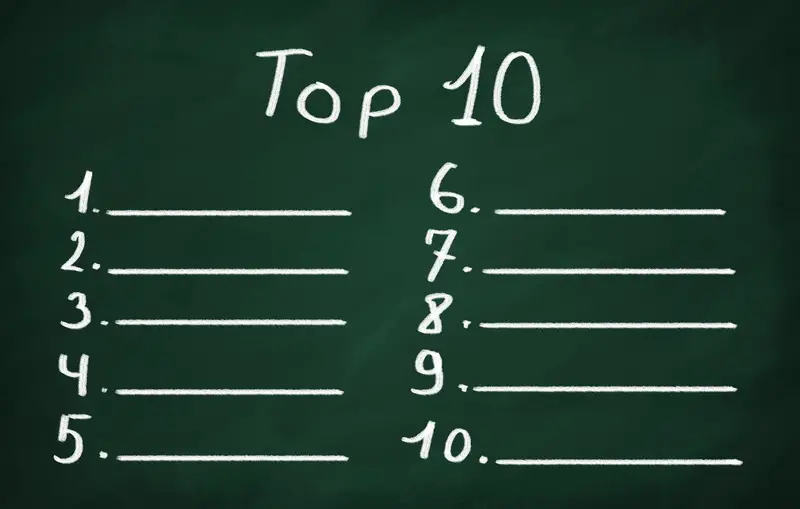

Lets Analyze The Top Credit Repair Companies on Google

- Lexington Law: Known for its legal expertise, Lexington Law does a good job of identifying violations. However, they often focus on quantity over quality.

- CreditRepair.com: Similar to Lexington Law, they identify violations but may not always prioritize the quality of these violations.

- Sky Blue: Does a reasonable job of identifying violations but lacks the comprehensive approach that others might offer.

- The Credit People: Focuses more on quick fixes rather than identifying deep-rooted issues or violations.

- Ovation Credit Services: They do identify violations but may not be as thorough as one would hope.

- Credit Saint: Known for a more personalized approach in identifying violations, which can be a plus.

- Credit Pros: They identify violations but may not cover all bases.

- CreditFirm.net: Focuses on legal violations but may not be as comprehensive.

- Pyramid Credit Repair: Newer to the scene, their approach to identifying violations is still evolving.

- Pinnacle Credit Repair: Excels in identifying both the quantity and quality of violations, ensuring a strong case for disputes.

Methods of Dispute

- Lexington Law: Primarily uses mail disputes.

- CreditRepair.com: Also leans heavily on mail disputes.

- Sky Blue: Uses a mix of mail and online disputes.

- The Credit People: Primarily online disputes.

- Ovation Credit Services: Mix of mail and online.

- Credit Saint: Primarily mail disputes.

- Credit Pros: Mix of mail and online.

- CreditFirm.net: Primarily mail disputes.

- Pyramid Credit Repair: Primarily online disputes.

- Pinnacle Credit Repair: Utilizes all methods—mail, online, and even phone disputes—to ensure the highest chance of success for expedited credit repair.

Frequency of Disputes

- Lexington Law: Sends disputes but not as frequently.

- CreditRepair.com: Similar frequency to Lexington Law.

- Sky Blue: More frequent disputes but may lack follow-through.

- The Credit People: Less frequent, focusing on a one-time clean-up.

- Ovation Credit Services: Moderate frequency.

- Credit Saint: More frequent than most but may lack persistence.

- Credit Pros: Moderate frequency.

- CreditFirm.net: Less frequent disputes.

- Pyramid Credit Repair: Frequency is still being established as they are newer.

- Pinnacle Credit Repair: Highest rate and frequency of disputes, conducted in a calculated and strategic manner this is a key element for expedited credit repair.

While many companies excel in one or two areas, Pinnacle Credit Repair stands out for its comprehensive approach. It not only identifies a broad range of quality violations but also employs all methods of dispute and maintains a high frequency of disputes. This multi-faceted approach gives Pinnacle a distinct edge in the credit repair industry.

Pinnacle Credit Repair: For Expedited Credit Repair

Navigating the maze of rapid credit repair options doesn't have to feel overwhelming. By zeroing in on the three pivotal elements we've outlined—Identifying Violations, Methods of Dispute, and Frequency of Disputes—you're well-equipped to make a savvy choice that can expedite your credit repair journey. The quicker you revamp your credit, the faster you'll unlock the doors to a more prosperous financial landscape.

How fast can a credit repair company work?

Credit repair can be a time-consuming process, but a reputable credit repair company can help you get started quickly and efficiently. On average, it takes about three to six months to see significant results, but this can vary depending on your individual situation.

Some factors that can affect the speed of credit repair include:

The severity of your credit problems

The number of disputes you need to file

The responsiveness of the credit bureaus and creditors

Even if it takes several months to see a significant improvement in your credit score, it is important to be patient and persistent. Credit repair is a marathon, not a sprint.

Can you expedite credit score update?

There is no way to expedite a credit score update. The credit bureaus update credit scores on their own schedule, which is typically once a month. However, you can get a free copy of your credit report from each of the three major credit bureaus once a year at AnnualCreditReport.com. This can help you track your progress and make sure that any changes you have made to your credit report have been reflected in your credit score.

Who can fix my credit quickly?

Only you can fix your credit quickly. There is no magic bullet or shortcut to improving your credit score. The best way to fix your credit quickly is to address the underlying issues that are causing your low credit score. This may involve paying down debt, making on-time payments, and disputing inaccurate information on your credit report.

Can I pay someone to fix my credit fast?

Yes, you can pay someone to fix your credit fast. There are many credit repair companies that offer their services for a fee. However, it is important to be careful when choosing a credit repair company. Some companies make false promises or use unethical practices.

Before you hire a credit repair company, be sure to:

Research the company and read reviews from other customers.

Make sure the company is licensed and bonded.

Get a written contract that outlines the company's services and fees.

Also, be aware that no credit repair company can guarantee that they can fix your credit quickly or guarantee a specific increase in your credit score.

Here are some tips from Pinnacle Credit Repair to help you expedite the credit repair process:

Review your credit reports carefully. Identify any inaccurate or incomplete information.

Dispute any inaccuracies on your credit reports. Be sure to provide documentation to support your disputes.

Make all of your payments on time and in full. This is the most important factor in improving your credit score.

Keep your credit utilization low. This means using less than 30% of your available credit on each credit card.

Open new accounts of credit responsibly. Avoid opening too many new accounts in a short period of time.

By following these tips, you can help to expedite the credit repair process and improve your credit score faster.