Student loans are one of the most common ways that people finance their college education. However, they can also have negative consequences once you graduate, including a hit to your credit score and difficulty finding employment because of the debt hanging over your head.

This article will tackle 5 steps that you can take to help remove student loans from your credit report, so you can rebuild and start building credit good again!

1. Check your credit score

One of the first steps to eliminating student loans from your credit report is checking it. You should get a free copy of your credit score at least once per year, and you can visit MyFico.com or CreditKarma.com to do so easily online in minutes! Once you know where you stand with your credit score, the next step will be much easier for you as well - Request a copy of your free annual credit report from each of the three major reporting agencies.

2. Request a Copy of Your Credit Report

You can request one at AnnualCreditReport.com, you can get a free copy of your annual credit report, which you should receive in the mail within 15 days! and be sure to get these reports from Equifax, Experian, and TransUnion.

After receiving all three copies of your free annual credit reports - you'll have access to identify any incorrect items that may appear on each individual report- so don't forget this important step!

Once you have corrected anything with inaccuracies or mistakes on each account (so they match up), make sure it's noted as "Account Correction" when filling out the dispute form for the mistaken item(s).

If there are any mistakes or inaccuracies that were not identified in the previous step - contact each individual company (i.e., Navient) separately to dispute these items as well. This will both ensure accuracy AND remove any incorrect information about past due accounts from appearing on future reports while also improving your overall FICO score through time.

Once you've done this, try and get the student loan debt off of your credit report by filling out an "Account Correction" form for those items on AnnualCreditReport.com. You'll need all three copies of your free annual reports from Equifax, Experian, and TransUnion before submitting anything- make sure you have them!

3. Pay off Any Outstanding Debts, Including Student Loans

The most important tip is to get current with any outstanding debts. This includes paying off any student loans that are past due or in default, as well as making sure you're on time with other monthly bills like rent and utilities.

This will not only improve your FICO score but may also decrease the interest rate (APR) on future borrowing - meaning lower payments each month.

When you have paid down all of your debt, it's time to start increasing what's known as "credit card utilization." Credit cards should be used responsibly by charging a small purchase every now and then rather than carrying a balance from one month to another without using it at all.

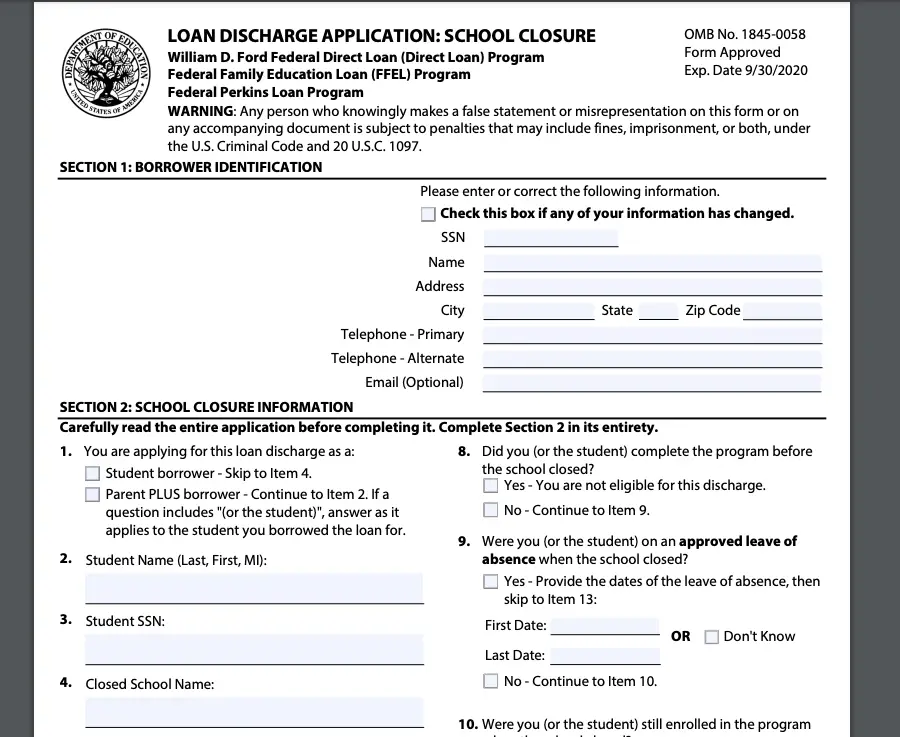

4. Submitting To The Bureaus

To get student loan debt removed from your credit report, you'll need to submit an Official Student Loan Discharge Form.

This is a form that must be submitted by the lender and will typically require additional documents in order to verify your identity.

Once this has been processed (which can take up to 4 months), any mention of the loans will no longer appear on your credit reports.

5. Wait for results

You will receive notification when it is removed from one or more reports within 30 days, after you submit it. If not, contact the bureau that has not yet updated their records with information about your successful removal request and inquire why it was rejected

If you are denied by one agency, don't be discouraged - just keep trying with another agency until you have success! Remember that they may take up to six months to process requests so be patient!