Building a Good Credit Score is a long term goal, not a short term goal. And yes, you can remove negative information lightning fast but you have to have a long term goal in order to build your credit.

There are six main factors of building your credit. Read on to know how you can increase your credit score fast.

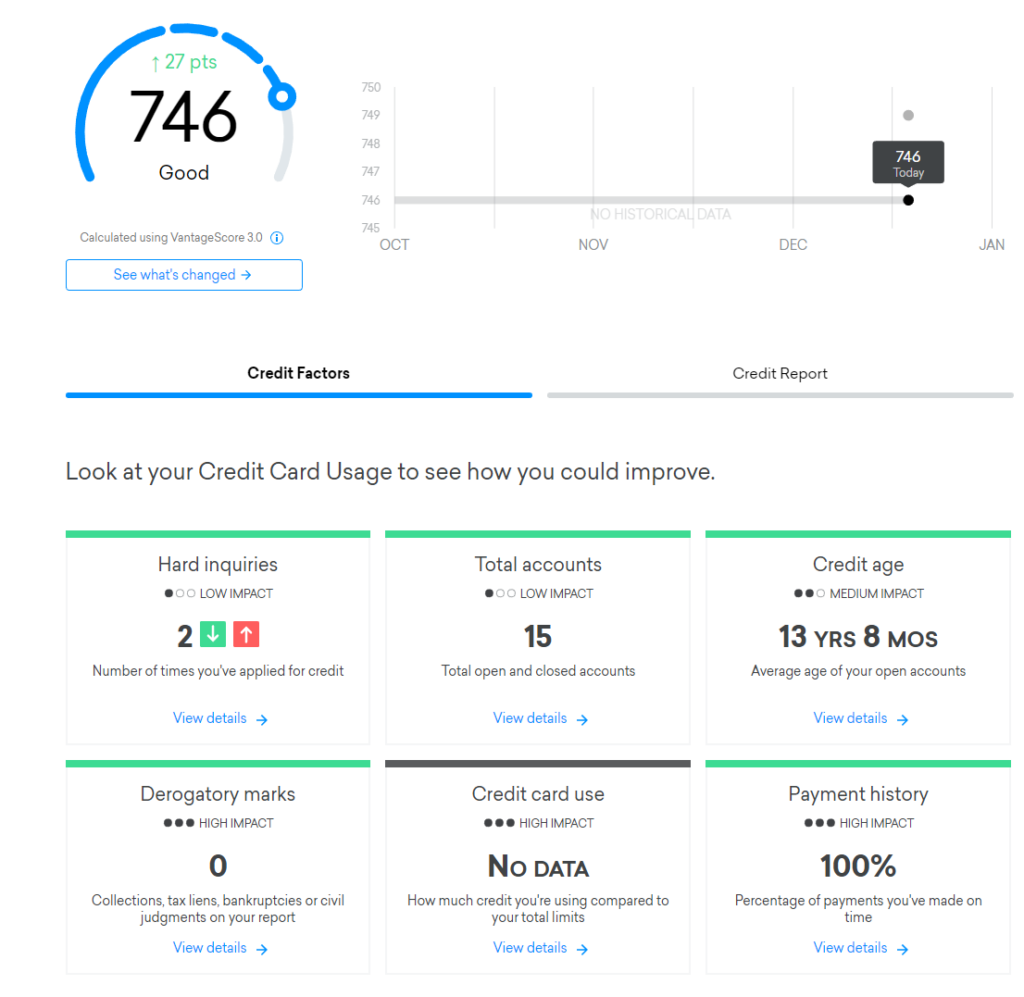

6 Factors of getting Good Credit Score

Credit Utilization.

Credit card utilization is the percentage of the credit card you are using in comparison to the limits. example if you have $1000 credit card limit and you've already spent $9900 that's 90% pretty much maxed out.

But there's one rule if you pay off the balance before the Statement accounts as a percentage that you're utilizing. So if you have $1,000 credit limit and You use $900 (90%). But if you paid off $800, that's a 5% utilization then you are in the good.

Alright. So make sure that your credit cards all of them. This is for revolving accounts. Another term you need to be familiarized with in terms of credit cards, Your credit cards have to be below 9% most of the time when the billing cycle or when the billing statement.

Payment History

Your payment history must be above 90% perfect on time payments. If you have 100 payments of all your credit cards and you miss 2 payments you're above.You should make an effort on to not having any late payments. But if you meet that role, don't worry, you could find a credit repair company, they can get those late payments off for you.

Derogatory Marks

Derogatory marks are negative, long-lasting indications on your credit reports that generally mean you didn’t pay back a loan as agreed. For example, a late payment or bankruptcy appears on your reports as a derogatory mark. These derogatory marks generally stay on your credit reports for up to 7 or 10 years (sometimes even longer) and damage your scores.

If you missed a credit card bill and it goes over 120 days delinquency, it's going to be written off as a charge off wear collection and that's a great way on how to get bankrupt. You better don't have it at all. And you will meet one of the six pillars of building.

Credit Age

Credit Age is average of all your credit accounts and how long you've used them. So from the minute you opened that credit card it's being calculated for you.

Most of us can't control this like if you're 18 and you just started with credit or if you're 20 and by 18 you already have some collections and some credit cards that you've maxed out, your credit card age is going to be only a couple to a few years. Or you're in your 40s. But there was a gap of time that you didn't have credit history, meaning you didn't have credit cards, So that's something that most of us cannot control. But be sure to check our article on how to add history to your credit. Credit age is really important.

The Amount Of Total Accounts

If you want a good credit score you need more than 21 accounts. Some of us have thinking that credit cards are a debt trap. Now that's not true. So you're going to have to constantly apply for credit whether it be an auto loan, credit cards, real estate installment loan or even like a personal loan. As long as all of them equate over 21 then your score is going to be good.

Hard Inquiries

This is what most of us are afraid of getting. There's a 5/24 rule with some credit card companies that You have to be mindful of, it mean you can't apply for more than 5 accounts within 24 months.

But it's also really important to understand. Hard inquiry is basically when a lender is pulling your credit, usually have to sign something whether it be online or in person. If you want to get a mortgage, auto loan or credit card, it's going to be a hard inquiry.

Conclusion

These six factors are calculated by Vantagescore. You have the six factors of building credit which are congruent with FICO scoring module. Payment history, credit card use, derogatory marks, credit age, total accounts hard inquiries as you can see on the picture above he has above the minimum of 21. That's why his score is 749. If your score is 620 or 580. Log into your credit karma, use it as a focal point on how to get a good credit score.

If you really want to step up your game, check out the new eBook I wrote for you, the Credit Repair 101. Simple instructions, and illustration will help you learn how to boost your Credit Score, and other amazing credit tips & tricks. Check out the samples on the product page.