In this article, I'm going to show you how to boost your credit score within 30 days. Doing this is kind of temporary because you actually have to do this every single month, in order to maintain the benefit. But if you stop doing it your credit score will drop back down.

The rule here is You need to pay your credit card payments before the statement date, and I'll explain to you in this article why that helps.

What is the 15/3 Credit Card Payment Hack?

The 15/3 credit card payment hack is a strategy for credit optimization. You need to make two credit card payments per month. Just like the name (15/3), one payment 15 days before your statement date and a second one 3 days before it.

It's a simple rule, right?

How do 15 and 3 credit hacks work?

Credit card payment hacks can be confusing, especially for those who are new to the world of credit cards. The 15/3 hack is no different. This hack is based on the 15th of the month and the 3rd business day of the month. In order to understand this hack, you need to know how credit card billing cycles work.

Credit card billing cycles are the periods in which your credit card company calculates your purchases, balances, and interest charges. They usually last between 25 and 31 days and start on the day that you first use your credit card. The billing cycle is followed by a due date, which is the date by which you need to make your minimum payment.

The 15/3 hack works by taking advantage of the timing of the billing cycle and the due date. If you make a purchase on the 15th of the month, the billing cycle will be initiated, and the due date will be set for the 3rd business day of the next month. If you make the minimum payment on this due date, you will avoid paying interest charges on your purchases, as the billing cycle will have been reset.

The 15/3 Credit Card Payment Hack: How to Use It

The 15/3 credit card payment hack is a great way to save money on interest charges and to keep your credit score intact. Here are some tips on how to use this hack to your advantage:

- Know your billing cycle: To take advantage of the 15/3 hack, you need to know when your billing cycle starts and when your due date is. You can find this information in your credit card statement or by contacting your credit card company.

- Plan your purchases: Make your purchases around the 15th of the month, so that you can take advantage of the hack. This way, you can minimize the amount of interest you'll have to pay.

- Make the minimum payment: To avoid interest charges, make sure to make the minimum payment on your due date. This will reset your billing cycle and give you more time to pay off your balance.

- Pay off your balance: If you want to take full advantage of the 15/3 hack, you should aim to pay off your entire balance before the next billing cycle. This will help you avoid interest charges and keep your credit score intact.

Best time to make Credit Card Payment

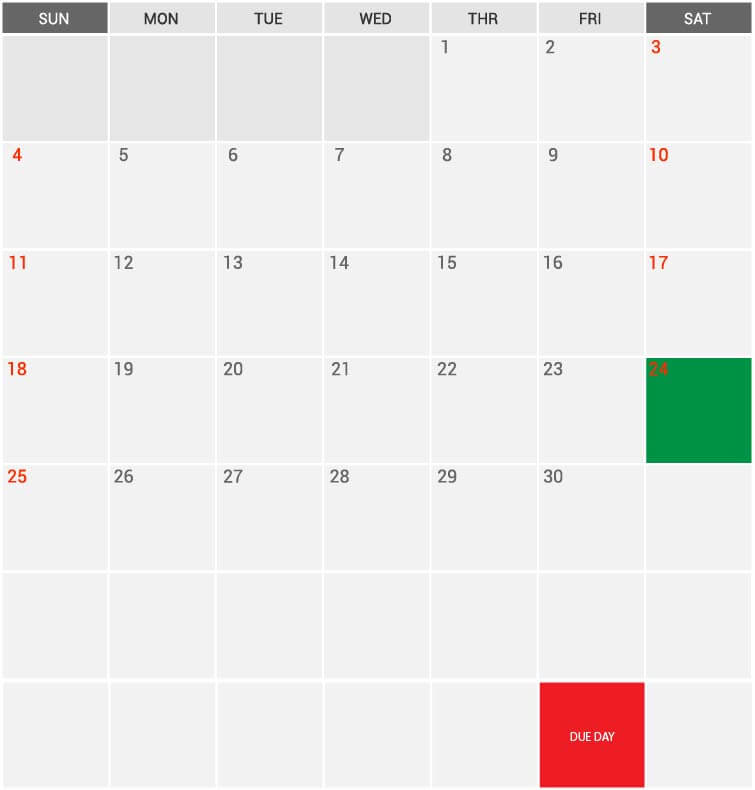

Now you're on your credit card account, it usually closes around the same day every single month. Let's just pretend the 24 is your closing date:

Your credit card company will report to the credit bureaus if you've been active and you owe them this month. The effort here is to go in there before the reporting date and change your balance on your credit card by paying it all up.

Normally, your credit card will have a closing date and then they'll send out the bill a few days later. Then after you get the bill it will be due a few weeks later after that, normally you would pay maybe sometimes right on the due date, or couple of weeks later (Red area on the picture above).

Reduced Credit Card Utilization

Even if you pay your bills in full and on time every single month, you can still benefit from this method, because you're going to have a certain amount of utilization on your credit card. And if you can get that to zero you'll actually boost your credit score.

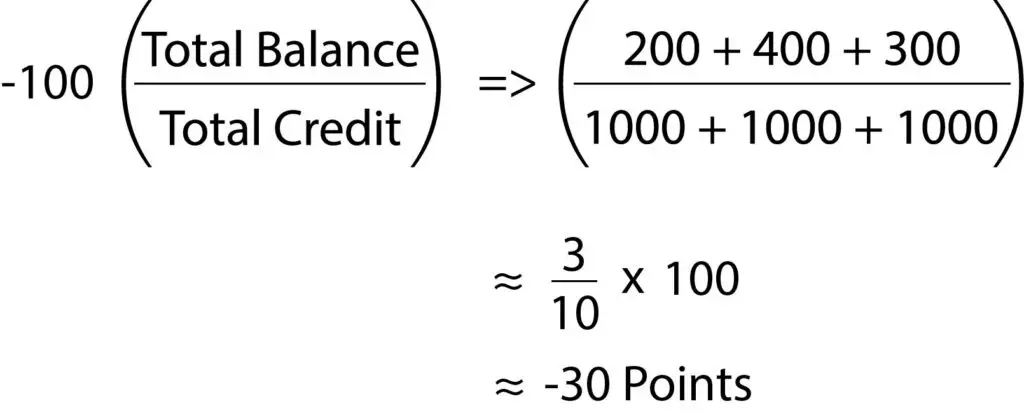

Here's a hypothetical model of what I think it's going on with the credit utilization

The point here is that the more you utilize your credit card, the more balanced you carry, and the more it's going to negatively affect your credit score.

I put a number of about 100 here because I think that's how much it affects your credit score if you happen to use up all your credit. so if you use up the total balance of your total credit, in other words, you use up all your credit cards to the max. Max them out but maybe you pay them all off every month anyway, it's still going to negatively affect your credit score by about 100 points, I estimate.

Let's look at a typical case: let's say you have 3 credit cards with a $1000 credit limit on each card, and you just do normal spending of $200, $400, and $300 for each credit card. If you add this up, it's $900 over $3000 which is 3/10. And 3/10 of a hundred it's about 30 points deduction in your credit score.

So you can see from here that if you happen to be able to set these to zero, you're going to be able to increase your credit score by a little bit every single month. The thing is in order to set these to zero you have to kind of monitor your credit card, and just go in there manually every single time before the statement date and pay it.

Do you need the 15/3 Credit Card Payment Hack?

This is really time-consuming and I actually don't like doing this myself I already have a good credit score, I don't do this but if you have a mediocre credit score and you're about to buy a car, get a mortgage, or something this might be a good way to go in order to give yourself a temporary credit score boost.

Note: You might want to try this maybe a month or two before you actually use your credit card to actually see that.

Why do you need the credit card payment hack?

There's a difference you might say "hey why don't I just pay everything off and not use the credit card at all and then I'll set those to zero", but the thing is if you set all those to zero and not use a credit card, your credit card will actually show up as idle, which means you're not using a credit card, which will actually not help your credit score at all.

Instead of zero maybe you can just spend $1 on each card and then pay everything else with cash, but that's not very good either because if you have cars that have cashback, you're forfeiting all that cashback in using a card, and the convenience of using cards.

When Does the 15/3 Credit Card Payment Hack Work?

So if you're thinking of using your credit score in the near future, it's viable to just go in your credit card and check out what the statement end date is for each card, make a note of that and make sure you go in there one day before the statement date, and pay off the whole card. This will give you a temporary boost in your credit score, and you need to repeat this every month in order to keep the same benefit.

I hope this helps everybody get a higher credit score, maybe even a lower interest rate on your car or house loan don't forget to comment down below if you have a question about this method. Thank you for reading my Credit Tips & Tricks. Maybe you want to check out my other article on How to Manufacture Spend in 2023

The 15/3 Credit Card Payment Hack: FAQs

- Is the 15/3 hack legal?

Yes, the 15/3 hack is legal, as it takes advantage of the billing cycle and due date of your credit card. However, it's important to make sure that you understand the terms and conditions of your credit card before using this hack. - Will the 15/3 hack work for all credit cards?

No, the 15/3 hack may not work for all credit cards, as every credit card company has its own billing cycle and due date policies. It's best to check with your credit card company to see if this hack will work for your particular card. - Can the 15/3 hack harm my credit score?

No, as long as you make the minimum payment on your due date and pay off your balance, the 15/3 hack should not harm your credit score. However, if you don't make the minimum payment or if you consistently carry a high balance, your credit score may be negatively impacted.